The acronym IVTM (IMPUESTO SOBRE VEHÍCULOS DE TRACCIÓN MECÁNICA) corresponds to the Tax on Mechanically Traction Vehicles that every owner of a motor vehicle considered fit to circulate must pay annually in Spain, the owner of a vehicle on the 1st of January of a given year is liable for the tax of whole year, even if your local taxes get charged middle of the year and you have sold the car just after the 1st of January you will receive the request to pay the tax.

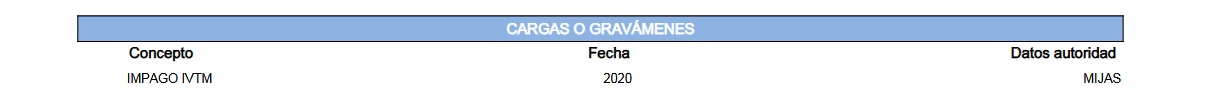

This tax is managed by the town councils of each locality / town or by the SUMA offices in some areas, the DGT (Spanish Traffic Department) has nothing to do with these taxes. However, if the DGT is notified by one of the previous mentioned, it will not be possible to change a vehicle owner if the Vehicle Tax for the year immediately prior to the current year appears as unpaid in the DGT Vehicle Registry.

In any case, it will be necessary to know if the DGT is aware of the non-payment of the municipal tax, since the City Councils must communicate the non-payments to Traffic Department, and in some cases, depending on the city council, this is delayed, or not communicated, so It’s possible that you have an unpaid receipt, but it has not yet been recorded in the Traffic vehicle registry.

As is customary in all taxes managed by the government, the city council or any other public authority, not paying within the voluntary period and manner will incur surcharge that must be assumed within the period indicated together with the notification of unpaid road tax. Eventually the government will try to charge the pending amount from your bank account. In the event of insufficient funds or impossibility of charging the pending amount, an embargo annotation on the vehicle is very probable or almost certain.

© Copyright 2026. VehicleCheck.es All Rights Reserved. | Privacy policy | Spanish Vehicle Reports | ITV stations in Spain

BYRNECARS S.L. - NIF: B42547265